Investing in Real Estate with No Cash or Credit: An Introduction

Entering the property market without upfront funds or credit is challenging, but inventive approaches open doors. Using contract assignments, seller carry financing, lease-options, and joint investments, you can participate in real estate with negligible upfront costs. We’ll delve into actionable techniques for securing and monetizing property rights without banks.

For more information on investing without cash or credit, go to: real estate wholesale software

Innovative No-Money-Down Techniques

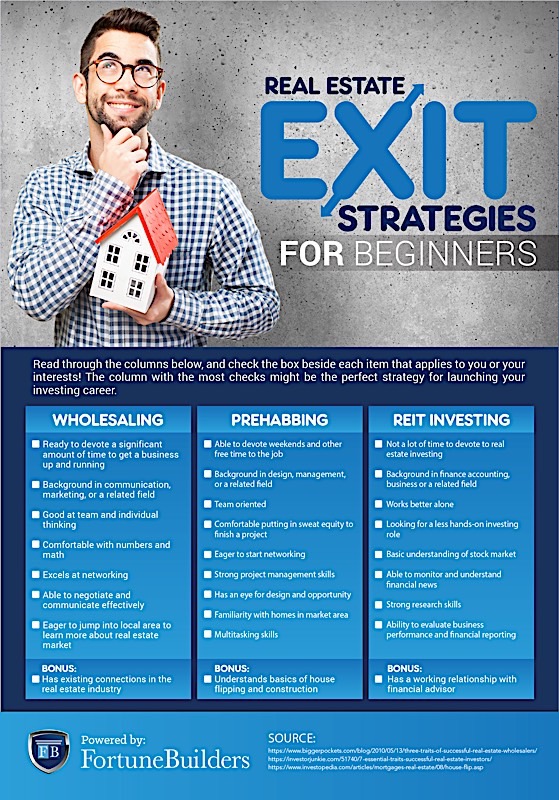

One powerful approach is wholesaling, where you secure a property contract below market value and assign it to an investor buyer for a fee. Since you act as a middleman, wholesaling avoids mortgage hurdles and ongoing property expenses. Effective wholesaling demands accurate deal evaluation, a robust buyers list, and persuasive negotiation.

Owner Carryback and Rent-to-Own Strategies

Seller financing involves structuring a deal where the property owner carries the loan, letting you pay them directly over time. Lease options let you rent a property with the right to purchase at a preset price, giving time to improve credit or secure funding. Through creative financing, you occupy or contract to buy now while postponing full payment.

Collaborative Deals for No-Cash Investing

Partnering with investors who have capital but lack deal-finding skills can be mutually beneficial. Profit-share agreements divide returns based on each party’s contribution, aligning interests and minimizing personal risk. Clear communication, legal documentation, and shared goals are vital for successful real estate partnerships.

Top Resources to Fuel Your Creative Deals

Using digital platforms such as CRMs and valuation tools keeps your pipeline organized and efficient. Online marketplaces and networking forums connect you with sellers open to owner financing or lease-option arrangements. Educational platforms deliver proven tactics and real-world examples for mastering alternative property funding.

Strategies to Excel without Capital or Credit

Rigorous due diligence prevents costly surprises and ensures deal viability. Develop a robust cash-buyer list or funding partners to ensure swift assignment and closing. Master persuasive communication and clear value presentation to negotiate favorable terms with sellers and investors.

To learn more about alternative real estate investing methods, go to: real estate rehab software

Final Thoughts on No-Cash Real Estate Investing

While unconventional, no-money-down techniques can yield substantial returns when executed properly. Integrating these creative methods lets you grow your holdings steadily, even without personal funds or credit. Begin with deep learning, clear paperwork, and strategic networking to embark on no-cash investing. With persistence, transparency, and continuous improvement, investing in real estate without traditional financing can become a reliable wealth-building strategy.